The U.S. Consumer Price Index increased 2.3% year-over-year in April 2025, under economic expectations and its lowest level since February 2021, based on data from the Bureau of Labor Statistics. The moderating inflation is welcome news to American consumers following a few years of strong pressure on prices but also challenges the Federal Reserve to reconsider its upcoming policy move as it nears its 2% inflation rate target.

April inflation data show widespread moderation

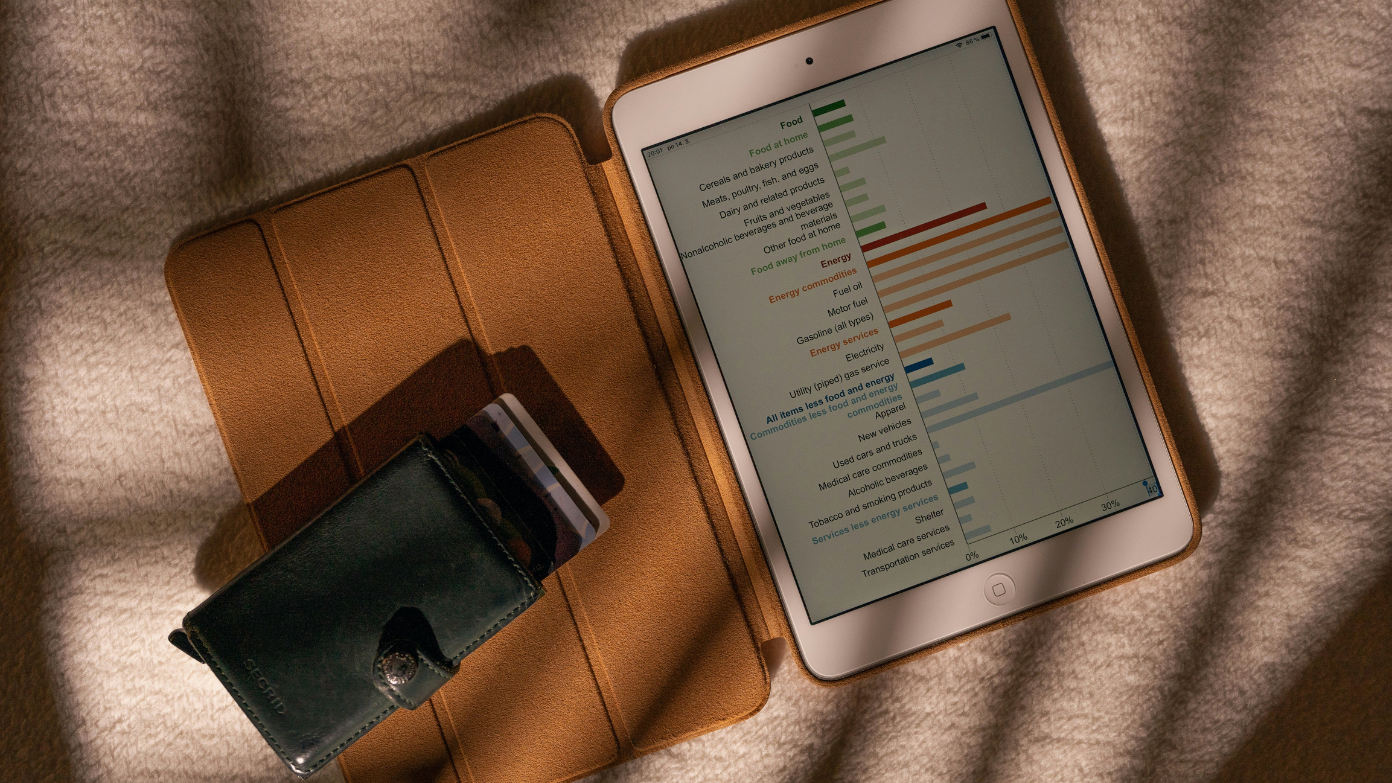

April’s 2.3% price increase was a modest deceleration from March’s 2.4% year-over-year rate, and the core CPI-minus volatile food and energy prices-increased 2.8% year-over-year. Seasonally adjusted, prices increased 0.2% for the month, reversing last month’s 0.1% decline. Moderation resulted from divergent trends among broad spending categories that saw shelter and energy prices offsetting occasional declines in food prices.

Shelter and energy balance out food price decreases

Shelter prices accounted for over half of April’s monthly inflation increase, rising 0.3% as housing demand continued to outstrip supply in major urban areas. Energy prices rose 0.7% on balance, with electricity (+1.2%) and natural gas (+2.4%) increases more than offsetting a 2.1% fall in gasoline prices. Meanwhile, food prices declined 0.1% per month-the first decline since mid-2023-led by a 0.4% decline in the prices of commodities like cereals, meats, and vegetables. Restaurant prices continued to increase, however, at a 0.4% per month clip.

Inflation falls below economic estimates

The 2.3% reading came in below consensus estimates of 2.4%, surprising analysts who anticipated persistent price pressures in service sectors. This marks the fourth consecutive month of disinflation, extending a trend that began in late 2024 following aggressive Federal Reserve rate hikes. Notably, April’s annualized rate is now just 0.3 percentage points above the Fed’s target, the narrowest gap since the pandemic-era inflation surge began.

Policy implications for the Federal Reserve

The cooling numbers fuel speculation about what the Fed will do next. While core CPI is still 2.8% on an annual basis, the steady decline indicates that earlier monetary tightening has succeeded in dampening demand without inducing meaningful job market weakness. Policymakers are still wary, however, because of continued shelter inflation, a lagging indicator of rental market data, and continued service sector price hikes in areas such as medical care (+0.3% month-over-month) and personal insurance (+0.5%).

Consumer relief and economic outlook

Households felt modest relief in lower food prices (-0.4% per month) and stabilizing durables, with falling apparel prices 0.2% and used car prices 1.1%. The transportation item experienced a varied range of trends, with airlines falling 2.6% despite increasing rates of motor insurance. Economists caution that tensions abroad with tariffs and possible energy market volatility could undo recent gains, but recent trends point to further movement toward price stability. As inflation rapidly approaches all-time highs, the spotlight turns to wages and jobs to see if the economy has the legs to keep on rolling as it finishes its “last mile” of disinflation.

Read more: U.S. and China to significantly ease tariffs for 90 days, White House announces – These are the products affected by the agreement between the…

Read more: A Royal Gift: Qatar’s Boeing 747-8 for Donald Trump May Become the Next Air Force One