Millions of Americans will be getting their Social Security benefit payments this October, and some of them will get monthly checks of as much as $5,108. This substantial payment period is a big moment for retirees, disabled employees, and survivors who rely on Social Security as a vital source of income. The subsequent installment, based on the Social Security Administration’s standard routine, will be distributed to millions of people nationwide starting October 8, 2025.

Payments up to $5,108 due this week

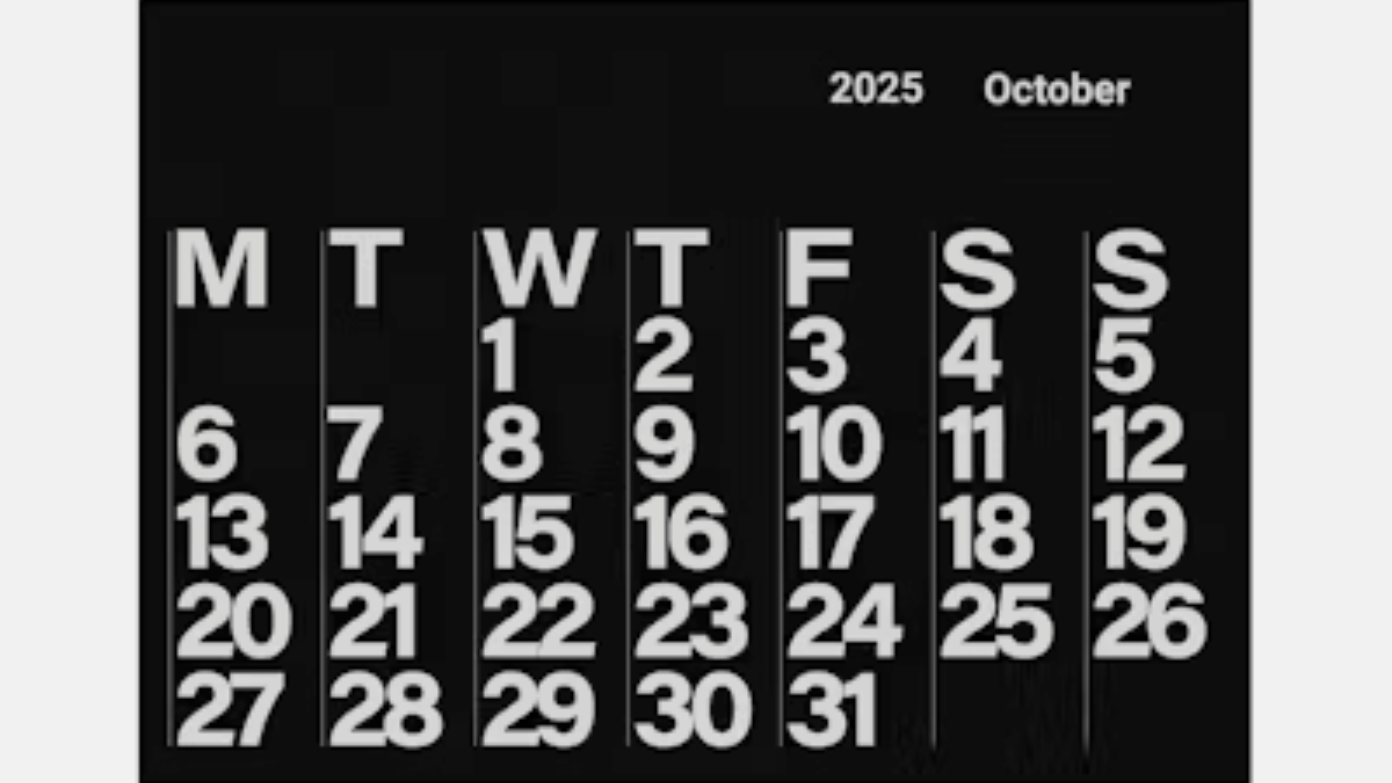

The Social Security Administration (SSA) is making the second payment of Social Security benefits for October on Wednesday, October 8, 2025. The payment is in line with the SSA’s staggered payment schedule by recipients’ birthdays. Exactly, birthday recipients between the 1st and the 10th of the month will get their monthly benefit on this day. Those whose birthdays are between the 11th and 20th will be paid on October 15, and recipients with birthdays between the 21st and 31st will have their deposits made on October 22. Also, recipients of Supplemental Security Income (SSI) benefits received their payment a bit earlier on October 1 because SSI payments are always made on the first of every month.

This October 8 issue pays benefits up to the maximum monthly Social Security retirement benefit of $5,108. This is aimed at those who have 35 years of working history, maximum taxable lifetime earnings throughout their working years, and delaying claim of retirement benefits until age 70.

Understanding the benefit amounts

The actual dollar value of Social Security benefits received by each individual fluctuates mainly on their lifetime earnings record, the age when they retire or receive benefits, and their own eligibility class. For October 2025:

- The average retirement benefit is about $1,907.

- Early retirees who receive benefits starting as early as age 62 can receive up to $2,710.

- Full retirement age (age 67) recipients receive a maximum of $3,822.

- Recipients who wait until age 70 receive the maximum of $5,108.

These figures demonstrate how waiting to collect Social Security increases monthly payments because delayed retirement credits are awarded. Most recipients claim less than the maximum due to changes in earnings and timing of claims.

Who receives these payments?

More than 71 million Americans receive Social Security or SSI benefits. There are diverse beneficiaries such as retired workers, disabled individuals, survivors of the deceased workers, and disabled or elderly low-income people who are entitled to SSI. Social Security provides needed income assistance so that most of the beneficiaries can afford living expenses, medical attention, and household expenses.

Social Security retirement benefit eligibility comes through having sufficient work credits earned through payroll taxes during one’s lifetime. The first time an individual is eligible to receive retirement benefits is age 62, but collecting early reduces monthly benefits while delaying past full retirement increases benefits. SSI offers additional aid on the basis of predominantly low income to individuals who meet certain financial requirements.

Payment distribution and convenience

Social Security benefits are paid mainly via direct deposit to bank accounts of recipients for convenience and security, with prepaid debit cards available as an alternative for the unbanked. The SSA phased out paper checks at the end of September 2025, urging all beneficiaries to make the shift to electronic payments. Recipients generally receive access to their funds earlier on planned deposit dates.

October 2025 payments maintain SSA’s birthday-based schedule to manage the distribution of millions of monthly benefits efficiently. Under this system, recipients can anticipate when funds will be received and organize their finances accordingly.

What to expect moving forward

Recipients are also asked to observe closely for their payments on time. There may be a delay of a few days due to processing or administrative issues, and beneficiaries are asked to wait for a couple of days before claiming lost payments from the SSA. The SSA also occasionally holds back payments from time to time for the recovery of overpayments or other debt liabilities, which may reduce monthly amounts for some individuals.

In the latter part of this month, the SSA is scheduled to come out with the 2026 Cost-of-Living Adjustment (COLA), something that will further increase benefit amounts to match rising inflation. Beneficiaries may prepare by looking at their current benefits and what Medicare premiums could offset net changes.

In short, this October is great news to millions of Americans as the Social Security benefits up to $5,108 are distributed throughout the nation starting from October 8. The disbursements are a significant source of funds for many and demonstrate ongoing efforts in keeping the program responsive to economic conditions and yet remain dependable. Beneficiaries are advised to be aware of the timing of their payment as well as any possible future changes to further strengthen their financial security.