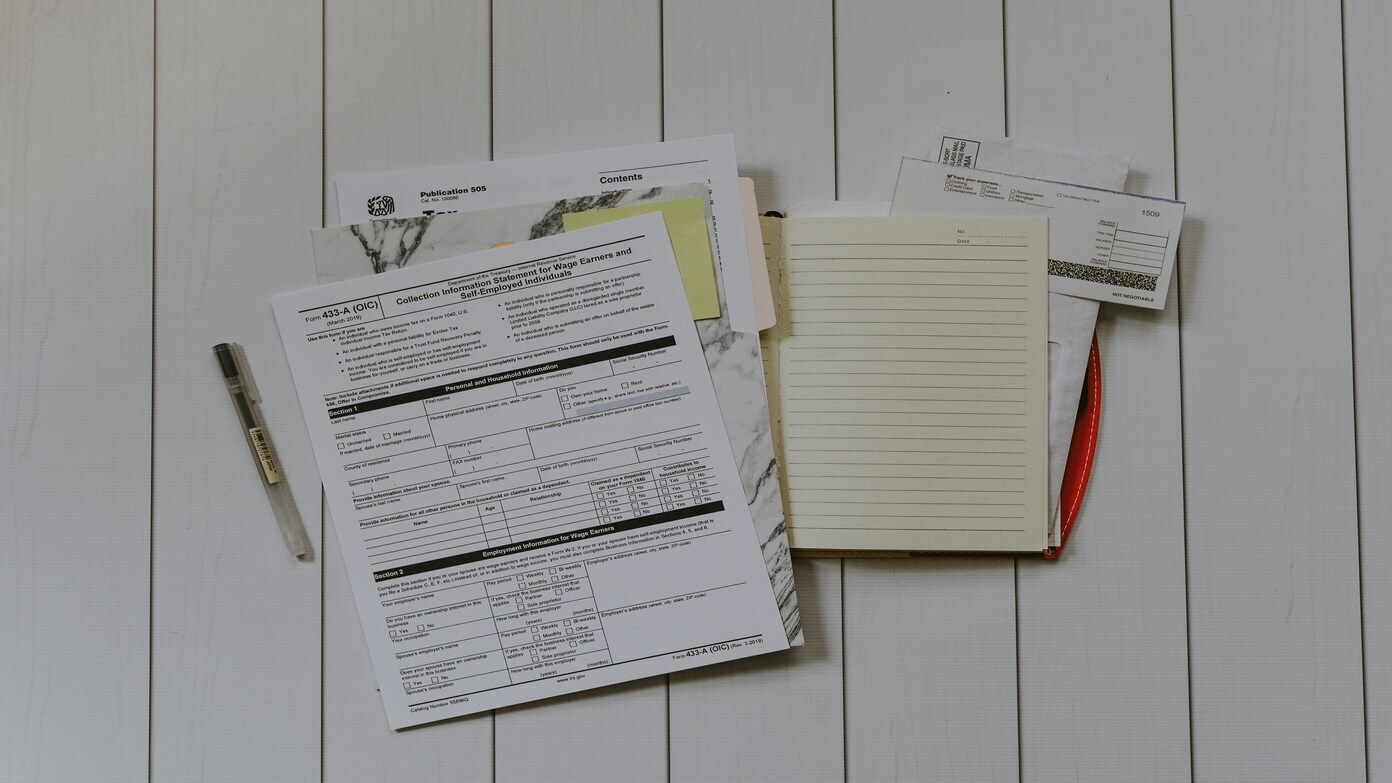

The IRS provides multiple ways for taxpayers to access their tax records, including transcripts of past tax returns, tax account details, wage and income statements, and verification of non-filing letters. These records can be obtained online or by mail, depending on your preference and eligibility.

If you need a business tax transcript, different steps are required. Be sure to check the IRS guidelines on how to request a business-related tax transcript.

Accessing tax records online

The quickest and most efficient way to access your tax records is through your Individual Online Account on the IRS website. This platform allows you to:

- View, print, or download your transcripts

- Check how much you owe

- Review your payment history

- Find your prior year’s Adjusted Gross Income (AGI)

- Access other important tax-related documents

Important note:

The availability of your current year’s transcript depends on how you filed your return—electronically or by mail—and whether you had a balance due. These factors may affect when you can access the transcript.

Alternative: Requesting a transcript by mail

Although online access is the fastest method, some individuals may not be able to register for an online account. In such cases, you can request a transcript by mail instead.

What You Need:

To receive a transcript by mail, you must provide the mailing address listed on your most recent tax return.

What You Get:

- Tax return or tax account transcript sent via mail

- Delivery within 5 to 10 calendar days to the address on file with the IRS.

Requesting a transcript by phone

You can also request a transcript by calling the IRS automated transcript service at 800-908-9946.

If you need a tax transcript for the Free Application for Federal Student Aid (FAFSA), refer to IRS guidelines specifically for student financial aid applications.

Data security and privacy

To protect your personal information, transcripts issued by the IRS will have partially masked details, hiding sensitive data while keeping financial information fully visible. This ensures they can still be used for tax preparation, representation, or income verification.

If you require a complete copy of your original tax return, you must submit Form 4506, Request for Copy of Tax Return.

Warning: Beware of IRS scams

The IRS does not contact taxpayers via email, text message, or social media to request personal or financial information. If you receive an unsolicited message claiming to be from the IRS, do not respond or provide any information.

To report suspicious communications, visit the IRS Report Phishing page for guidance on how to handle potential scams.

For more details, check out the IRS Transcript Services for Individuals—FAQs section on their official website.

Read now: Goodbye to the COLA hike in 2026 – Here’s why your Social Security checks won’t be as high as in previous years thanks to…

Goodbye to Elon Musk – Here are the five benefits you can apply for directly on the Social Security website

Goodbye Medicare as you know it – Changes with the WISeR model coming Jan. 1, 2026 in these states with affected services

Millions of Americans are receiving malicious emails from so-called Social Security officials – Beware if this email arrives in your inbox

Bad news for Social Security and Medicare – Here’s the new date when they could stop paying out with a cut of up to…