The tax filing landscape is going to alter significantly for taxpayers residing in 25 states in 2026 as a result of eliminating popular federal programs and complex state tax conformity decisions as a result of the One Big Beautiful Bill Act (OBBBA). These changes will directly influence the way Americans do their taxes and potentially their overall tax bill as states struggle with whether to sign on or not to federal tax changes that could drain them of billions of dollars in revenue.

Direct File Program elimination impacts 25 states

The first change to affect taxpayers in these 25 states is the elimination of the IRS Direct File program, which allowed eligible residents to prepare and file their federal and state taxes for free directly from the IRS website. Former IRS Commissioner Billy Long confirmed elimination of the program at a July 2025 National Tax Professionals conference by openly stating that Direct File is “gone” and that “Big Beautiful Billy wiped that out”.

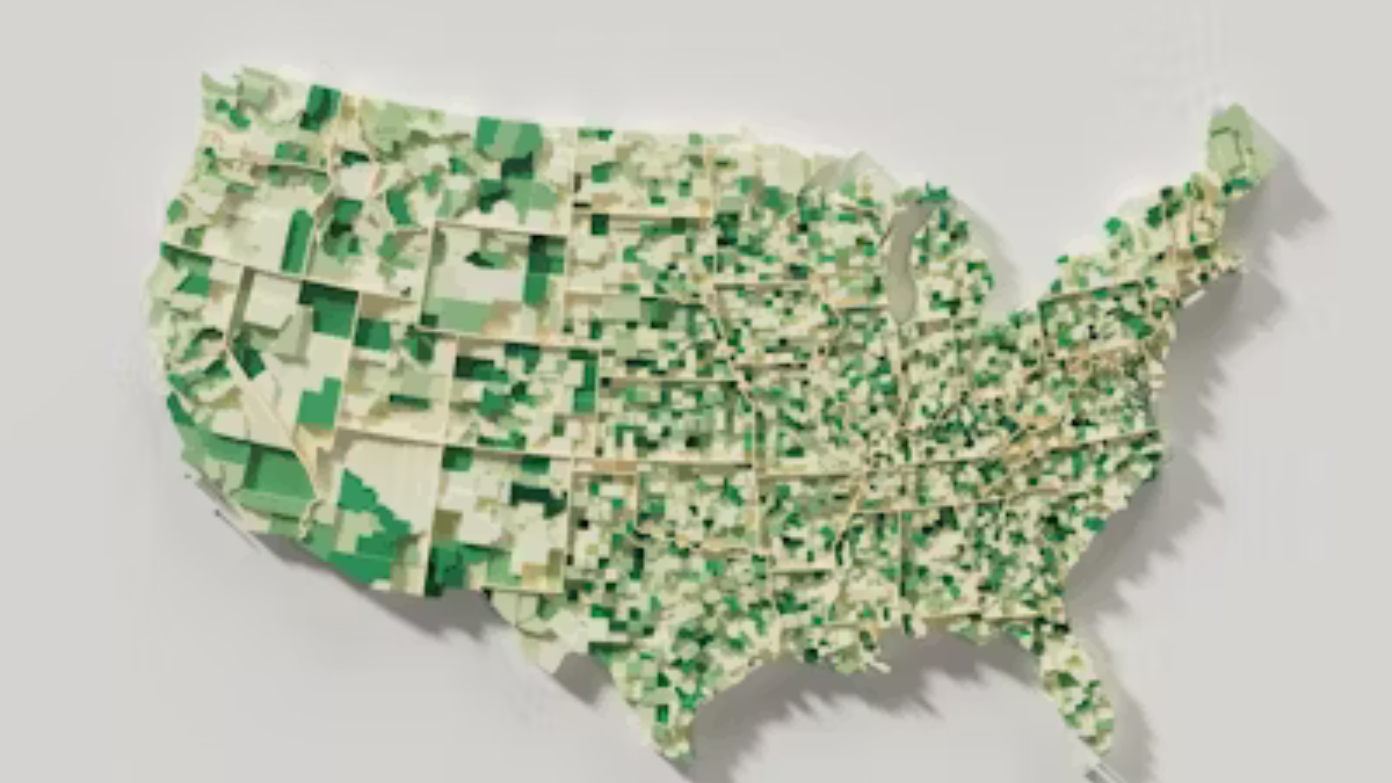

The 25 states that offered Direct File for tax year 2025 were Alaska, Arizona, California, Connecticut, Florida, Idaho, Illinois, Kansas, Maine, Maryland, Massachusetts, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Oregon, Pennsylvania, South Dakota, Tennessee, Texas, Washington, Wisconsin, and Wyoming. These states now have to direct taxpayers to utilize the other filing options, creating potential confusion and extra cost to individuals who utilized the free service.

The OBBBA mandates that the Treasury Department establish a task force with $15 million in appropriation to formulate a “better public-private partnership” between the IRS and private tax preparation companies to replace Direct File and the existing Free File program. The transition time can be confusing to taxpayers regarding what filing options exist for the 2026 filing season.

State tax conformity creates complex decisions

The Direct File repeal is but one aspect of the overall changes facing such states. More significantly, state governments will need to decide whether to conform their tax codes to the different federal changes included in the OBBBA, decisions that potentially will redefine state tax collections and taxpayer obligations.

States tend to track federal tax legislation in one of three manners: rolling conformity (by implementing federal changes automatically), fixed conformity (taking the Internal Revenue Code as of a certain point in time), or selective conformity (choosing chosen provisions). The timing of the July 2025 passage of the OBBBA, after most state legislative seasons, has posed particularly stringent challenges for states with fixed conformity systems.

SALT deduction changes drive revenue concerns

The greatest alteration affecting state budgets is the increase in the federal State and Local Tax (SALT) deduction ceiling from $10,000 to $40,000 for most individuals, with the ceiling phasing back down for high-income individuals and reverting back to $10,000 for individuals earning over $600,000. It will take effect for tax year 2025, i.e., taxes filed early 2026.

Massachusetts is a worst-case instance of the budgetary impact, with the state’s Department of Revenue estimating a $222 million loss in revenues from the SALT hike alone, part of an overall $650 million cut from federal tax policy reform. The high SALT cap reduces state tax collections since it allows taxpayers to deduct higher state and local taxes on their federal returns, reducing the weight of state taxes and reducing pressure for lower state tax rates.

States that adjust automatically based on federal tax legislation feel budgetary pressures instantly, as the change affects their ongoing current fiscal year revenue. These states simply must react immediately to either decouple from federal reforms or accept reduced revenue.

Research and development deduction impacts

Another significant provision affecting state revenues is the restoration of immediate deductibility of U.S. research and experimental expenditures, which businesses have been required to amortize over several years since 2022. Massachusetts projects this change alone will cost the state $288 million in fiscal year 2026, the single largest revenue effect of the federal law.

This change particularly affects states with big technology and pharma industries, as firms now have the ability to deduct research costs immediately rather than claiming them over a number of years. States that implement this federal change will see huge drops in corporate tax revenues.

Varied state responses and timing challenges

States are responding variously to these federal modifications based on their conformity approaches and budgetary situations. Maine is an illustrative example of the complexity at play. While allowing new authority to temporarily conform to federal modifications, Governor Janet Mills declined to enact this authority, so Maine residents will have to deal with an outlandish scenario where federal and state tax calculations diverge considerably for 2025.

Rolling conformity states automatically adopt federal changes unless they explicitly choose to decouple, but fixed conformity states must intentionally decide if they want to update their conformity dates. This creates a patchwork of different tax treatments across states, and complying is hard for taxpayers as well as for business entities that have operations in more than one jurisdiction.

Business implications and bonus depreciation

OBBBA also reinstates and extends various business tax incentives, including 100% bonus depreciation for qualified property and increased limits on expensing business assets. The provisions, along with changes to interest expense limitation deductions, create additional state revenue strains that vary depending on each state’s conformity approach.

Pass-through entity taxes, which many states implemented as alternatives to the original $10,000 SALT limitation, may be less attractive to taxpayers now that the federal SALT deduction has been increased substantially. States need to determine if they should maintain those regimes or reform them in reaction to changed federal incentives.

Timeline for State decision-making

The reduced timeline imposed by the OBBBA’s July 2025 implementation leaves the majority of states to only think about conformity decisions in their 2026 sessions, except for special sessions. This timing creates uncertainty for taxpayers and businesses making tax planning choices for 2025 since they can’t know which federal actions their states will adopt.

Tax professionals warn that this timing problem would create significant compliance issues, particularly for multistate taxpayers who would need to track disparate conformity options between states. States are pushed to resolve the conflict between the pressure for easy tax administration through federal conformity and the significant and pervasive revenue losses many federal provisions would create.