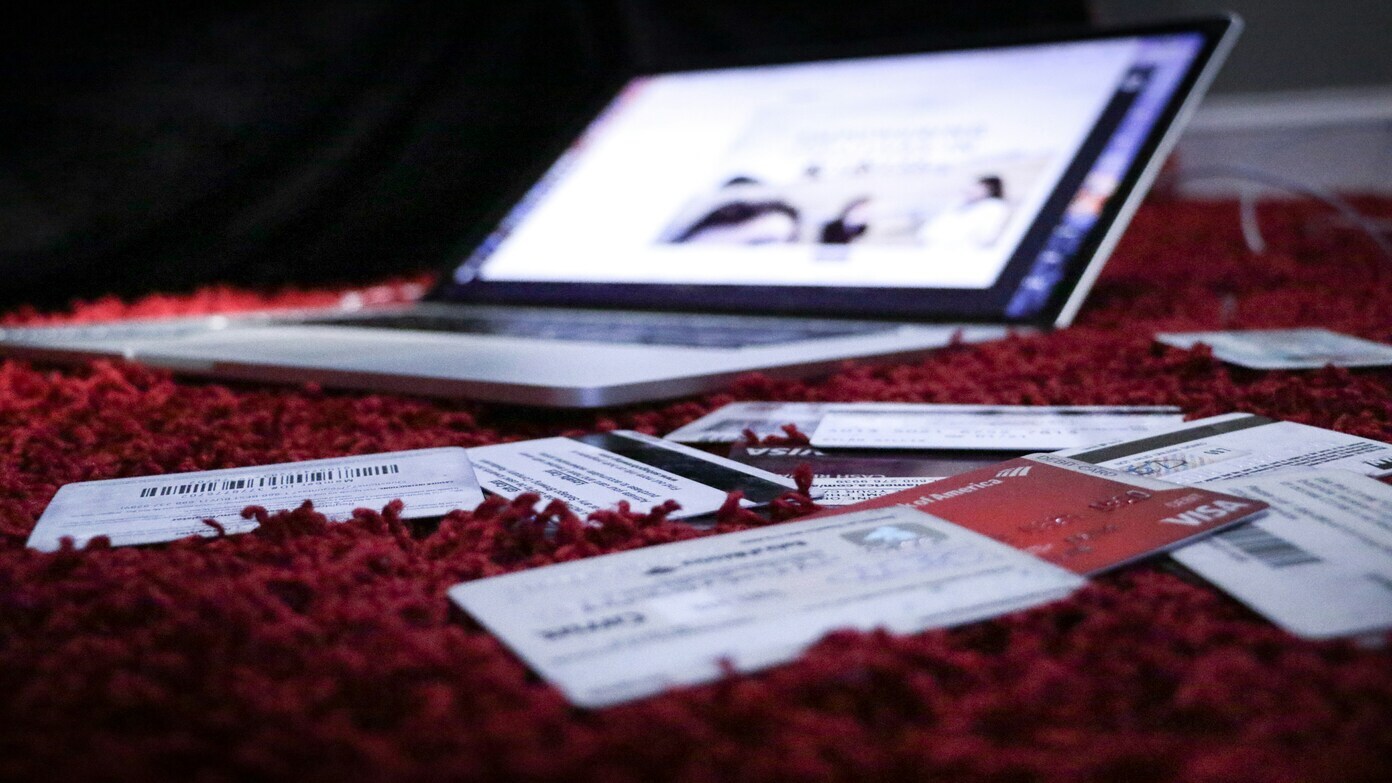

A major change is coming to how your credit score is calculated, especially if you use Buy Now, Pay Later (BNPL) products like Klarna, Afterpay, or Affirm. For the first time, FICO (the company behind the most widely used credit scores) will start including BNPL information in its scoring models. That means how you manage these payments can now positively or negatively impact your credit.

What is BNPL?

BNPL stands for Buy Now, Pay Later. It’s a type of short-term loan that enables you to pay for your purchase in installments, generally interest-free. It’s utilized by many as a substitute for credit cards, especially for online shopping or if they have to fund a big purchase. It’s extremely popular now, especially among young adults who may not yet have credit cards.

Why this matters for your credit

Up until now, most BNPL activity hasn’t been reported to credit bureaus such as Experian or TransUnion. That meant it was hidden from lenders. But all of that is set to change.

FICO is launching two new credit score models — FICO Score 10 BNPL and FICO Score 10 T BNPL — that will include BNPL loan history. So if you’ve been using BNPL a lot, lenders will start to see whether you’ve been paying those loans on time.

If you’ve been managing BNPL well, this could boost your credit. If you’ve missed payments or taken out too many BNPL loans, it could hurt your score.

A way to build credit—or damage it

Experts say this change could be good for younger people who don’t have much credit history yet. If they use BNPL responsibly, it could help them build credit faster.

But there’s a pitfall. BNPL is so easy to use, and shoppers find themselves with multiple loans and don’t really understand how much they’ll pay in total. In a recent Bankrate survey, nearly half of all BNPL users had problems, and the biggest was overspending.

What’s the delay?

While FICO is unveiling the new score models later this year, don’t expect an overnight change. Credit reporting is complex. Not all lenders use the newest FICO scores. Many use older iterations from 2009 or earlier.

Also, not all BNPL companies report to credit bureaus. Some, like Affirm, have started. But until more BNPL lenders report your data, it might take some time for the change to have a full impact on your credit score.

A new way to measure credit

BNPL loans don’t work the same way credit cards do. They are short-term, and the accounts open and close quickly. FICO had to find a new way to score these loans without unfairly penalizing users. They now look at BNPL loan trends over some time, rather than specific loans.

Bottom line

If you’re using Buy Now, Pay Later services, start treating them like any other loan. Pay on time. Don’t take out too many at once. Because soon, your BNPL habits might show up on your credit report, and lenders will be watching.